To be listed on the haciendadelalamo TODAY MAP please call +34 968 018 268.

article_detail

Date Published: 13/02/2026

Spain's population hits 49.6 million with foreign-born milestone

One in five residents now born abroad as migration drives record growth

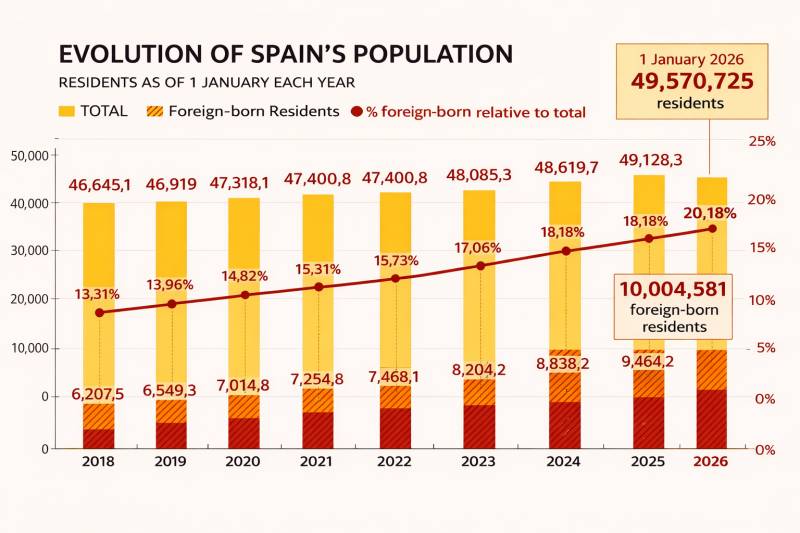

Spain's population has reached a new high of 49,570,725 as of January 1, 2026, up 442,428 from last year, according to the National Institute of Statistics (INE). For the first time ever, more than 10 million people, exactly 10,004,581, living here were born abroad, making up one in five residents and offsetting a drop in births among those born in Spain.

Spain's population has reached a new high of 49,570,725 as of January 1, 2026, up 442,428 from last year, according to the National Institute of Statistics (INE). For the first time ever, more than 10 million people, exactly 10,004,581, living here were born abroad, making up one in five residents and offsetting a drop in births among those born in Spain.Out of the total, 39.6 million were born in Spain, while 42.3 million hold Spanish nationality (many naturalised through residency, marriage or the Historical Memory Law) and 7.2 million have foreign passports, or 14.6% of the population. Migration expert Elisa Brey from Complutense University in Madrid welcomed the figures. "If it weren't for the arrival of migrants, Spain would lose population," she said, pointing to a fall of 18,696 Spanish-born babies in late 2025 alone.

New arrivals in the last quarter of 2025 were led by Colombians (36,600), Venezuelans (27,000) and Moroccans (22,000), drawn by job opportunities, existing communities and troubles back home like Venezuela's crisis. Departures were highest among Moroccans (13,000), Colombians (12,500) and Spaniards (7,900). Brey noted the "dynamism of the Spanish labour market" as a key pull.

Growth varies widely by region. The Balearic Islands top the list for foreign-born share at 29.27%, followed by Catalonia (26.11%), Madrid (25.7%) and the Valencian Community (25.45%). Provinces like Alicante (30.51%) and Almería (26.04%) stand out too, while Extremadura (6.59%) lags far behind. Nationally, households rose to 19.7 million by January 1.

The Valencian Community saw the biggest yearly jump at 1.78% (over 5.5 million total), followed by Castilla-La Mancha (1.31%), Aragon (1.26%) and Murcia (1.07%). Two-thirds of 2025's growth happened in the Valencian Community, Catalonia, Madrid and Andalucía.

This surge, building since 2022's economic recovery, means Spain could top 50 million by year's end - a stark contrast to the "demographic winter" of more deaths than births among natives. For those of us settled here, it shows how newcomers are keeping communities vibrant.

Loading

If you own property in Spain but don’t live there, you must pay tax – whether you use it as a holiday home, rent it out or sell it.

IberianTax helps non-resident property owners file their Modelo 210 tax forms quickly and securely. Our easy-to-use online platform simplifies the process of filing the Modelo 210 tax form, ensuring full compliance with Spanish tax laws. With step-by-step support and affordable pricing starting at just €34.95, filing your taxes has never been easier or stress-free.

Join thousands of non-resident homeowners who have chosen IberianTax as their trusted tax partner in Spain. Visit our website and sign up for your free account now.

What is the Modelo 210 tax form?

The Modelo 210 is Spain’s tax form for non-residents who own property in Spain. It is used to declare taxes related to your property.

There are different types, depending on the tax:

- Imputed Income (Modelo 210): Owning a property for personal use (i.e.: holiday home).

- Rental Income (Modelo 210): For income earned from renting out your property.

- Capital Gains (Modelo 210): For tax due when you sell your property.

How to file your non-resident Modelo 210 tax with IberianTax in 3 steps

- Create an Account: Sign up for free to start. You can get a free tax estimate by using our tax calculator and only pay when you submit your Modelo 210.

- Enter Your Details: Complete the simple IberianTax questionnaire with your property and personal information. Step-by-step guidance and examples are included.

- Submit Your Tax: Choose your payment method, and IberianTax will file your Spanish non-resident tax return online for you. Simple!

Why use IberianTax to file your Modelo 210?

- Fast & Easy: File your Modelo 210 online in minutes.

- Simple: Step-by-step questionnaire – no tax knowledge needed.

- Affordable: Services from €34.95 VAT inc., far less than typical €150+VAT.

- Flexible: File anytime, anywhere, with multiple payment options.

- Accurate: Built by tax experts with automatic checks.

- Secure: Data encryption and safe online payments.

- Certified: Approved by the Spanish tax authorities.

- Multilingual: English, French and German support available.

Whether you need to file taxes for personal use, rental income, or capital gains, IberianTax offers a comprehensive, reliable, and cost-effective solution for non-resident property owners in Spain.

Get started now on the IberianTax website and enjoy a 10% discount or, if you have any further questions, the team will be happy to answer them. Just use the contact box above, or fill in the contact form on their website.

Alternatively, you can send an email to contact@iberiantax.com and they will get back to you as soon as possible.

Contact Murcia Today: Editorial 000 000 000 /

Office 000 000 000